To watch the full exchange, click here.

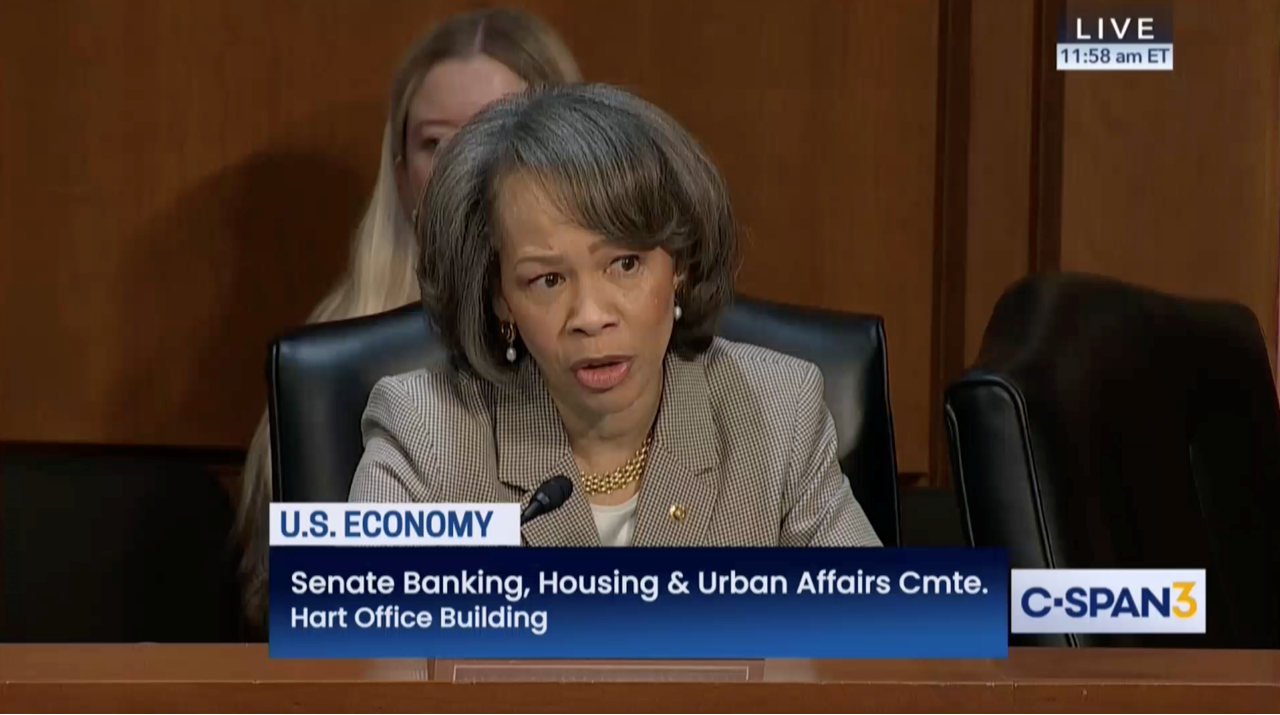

Washington, D.C. – Today, U.S. Senator Lisa Blunt Rochester (D-Del.), member of the Senate Committee on Banking, Housing, and Urban Affairs, questioned Chair of the Federal Reserve Jerome Powell about the impacts of the economy on hardworking Americans and their families.

Senator Blunt Rochester: “Thank you, Chair and Ranking Member, and thank you, Chairman Powell. It’s good to see you and thank you for meeting with me last week. We discussed everything from jobs and housing supply to the real impact on, Fed policies on all of our lives. And I also got a chance to share with you just the concerns and consternation of Delawareans who for the past few weeks, have been frightened by hirings, firings, and funding freezes, and just the real impact on people’s financial and personal data and information, when, you know, DOGE has access to this information. I’m hearing from my constituents as well about the potential shuttering of the Consumer Financial Protection Bureau. As Senator Warnock mentioned, CFPB has returned over $21 billion to millions of consumers…But I want to also highlight that it was your leadership in the Fed, working with Congress, and the Biden administration, to really help answer that question that you were asked about: if you had the choice to switch countries with France and Germany and others, that you said, no, you’d rather be here, and that success is a testament to all of us.

“We came together during a really tough economic time…Since Covid, we’ve seen a robust job growth. But we also have grappled with inflation that drove prices up for so many goods. And I’ve worked, to address one part of this phenomenon: our supply chain disruptions.

“In fact, I recently joined Senators Cantwell and Blackburn to reintroduce the bipartisan Promoting Resilient Supply Chains Act to address supply chain vulnerabilities. And while we see indications that inflation may be slowing, too many of our constituents are still facing high prices and economic uncertainty. We need to do everything that we can to address this anxiety and the realities that Americans are facing. And there seems to be a disconnect. While the economy is doing, you know, well here on the ground, people aren’t really feeling that. So, Mr. Powell, can you talk about, from your perspective, just what is driving this disconnect between traditional economic indicators, such as GDP growth and the stock market performance and the tangible benefits for families?”

Chair Powell: “I’d be glad to. So, it is clear that the overall aggregate numbers are just very, very good for the economy to, you know, 4% unemployment, inflation down to 2.6% last year, and the economy growing well in excess of 2%. These are good numbers. But, what people are feeling is the results of several years of inflation, and particularly for people in the in the low- and moderate-income category, they’re really feeling it.

“So, if you look at the earnings releases and press conferences that they do that companies like the dollar stores and things like that do deal a lot with low- and moderate-income people, they’re all telling you that those consumers are feeling really strapped. So, we do understand that, and we try to keep that in mind, even though we acknowledge that the overall data are good, we see what’s what people are feeling. And you know, that’s inflation. So, it’s just another reminder how much people hate inflation and how bad inflation is for people, high inflation. And you know, it just furthers our resolve to get inflation back to 2% and keep it there.”

To watch the full exchange, click here.

###